Inflation steadily declined in the second quarter, and there are signs that the labor market is softening. The cost of many construction materials stabilized at elevated levels after post-pandemic increases. There is optimism that, if the Federal Reserve cuts interest rates later this year as expected, it will spur private investment in new construction projects.

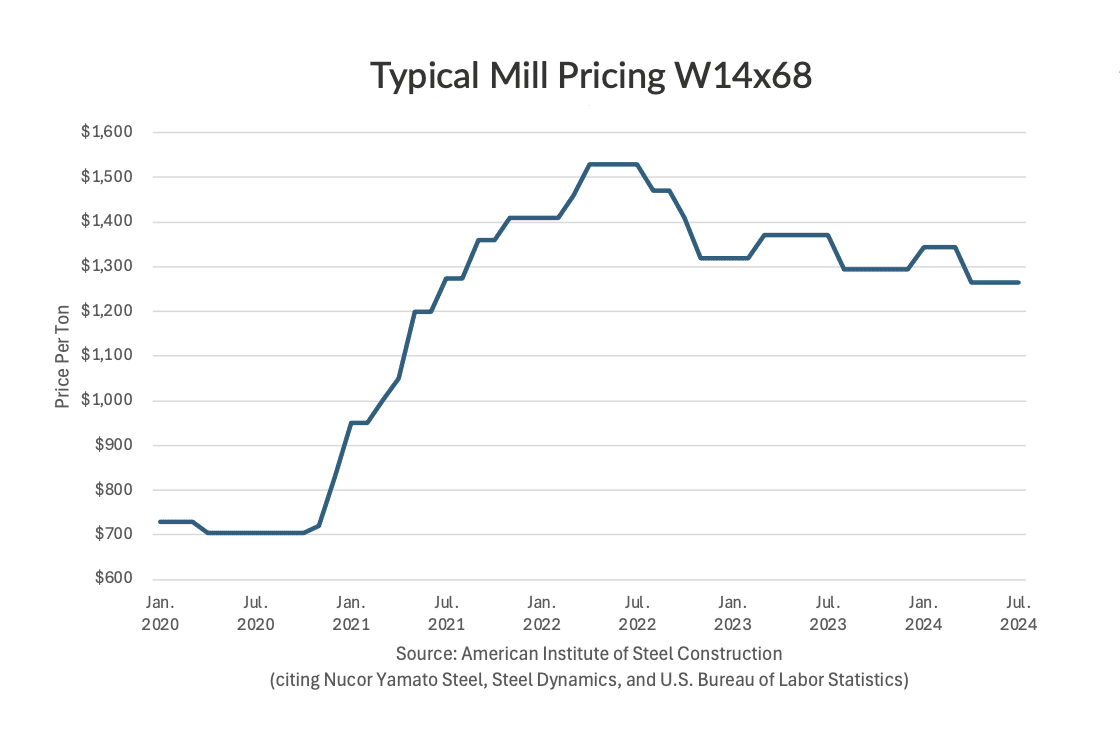

Material Input Costs | Steel

Steel prices have stabilized at elevated levels. For a decade before 2021, steel mill prices hovered between $750 and $1,000 per ton. Steel prices then rose significantly during 2021, peaked in 2022, and spent 2023 and 2024 slowly settling at elevated prices above $1,200 per ton. As of June 2024, typical mill pricing for a W12x68 member was $1,265 per ton. While 17% off mid-2022 highs, that price is 73% higher than pre-pandemic prices seen in early 2020.

The price of joists and deck has followed suit. The average combined price for joists and deck (not including tax) on buildings over 75,000 gross square feet (GSF) was $5.61 per GSF in the second quarter. While approximately half off peak prices ($10.65 per GSF) seen in 2021 and 2022, the price of joists and deck remains more than double what it was in Q2 2020. The current lead time for joists and deck is approximately 14-16 weeks.

SOURCES: American Institute of Steel Construction (citing Nucor Yamato Steel, Steel Dynamics, and the U.S. Bureau of Labor Statistics); Vulcraft/Nucor; Canam Steel Corporation; New Millennium Building Systems; Valley Joists + Deck

Construction Labor Costs

There are signs that the labor market is softening. First, after two years of above-average inflation, the growth of construction labor costs returned to average levels in the second quarter. The Employment Cost Index (ECI) published by the U.S. Bureau of Labor Statistics reported a 2.66% year-over-year (YOY) increase in construction industry wages and salaries during the period ending Q2 2024. The ECI likewise reported 2.77% YOY growth in construction industry total compensation (including wages, salaries, and employer costs for employee benefits) during the same period. These rates are near the average YOY growth rates for construction industry wages and salaries (2.70%) and total compensation (2.73%) since 2002.

Download the Q3 2024 Market Report

Click the button below to view and download Carroll Daniel Construction’s Market Report for Q3 2024.